The Best Is Yet to Come: Plan Ahead for Your Second Half of Life

People live longer!

- What income will there be after retirement?

- Don’t outlive your money.

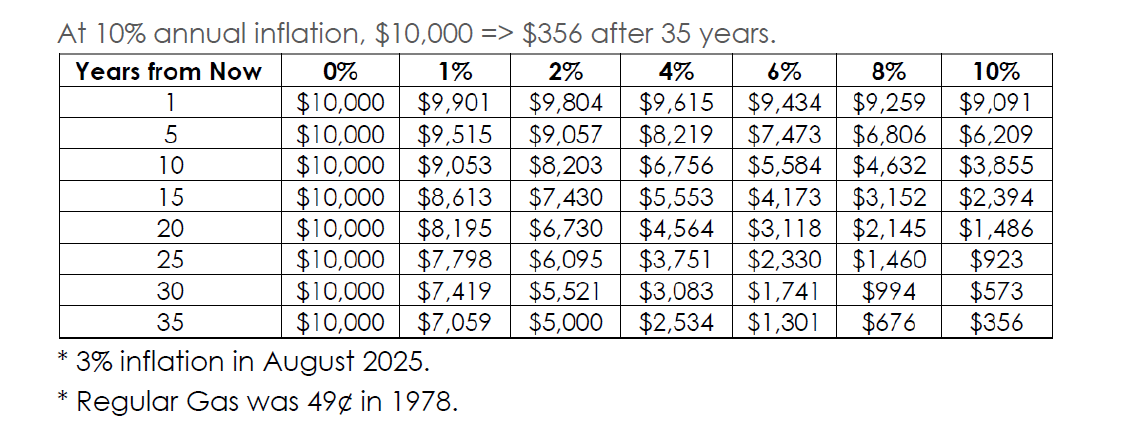

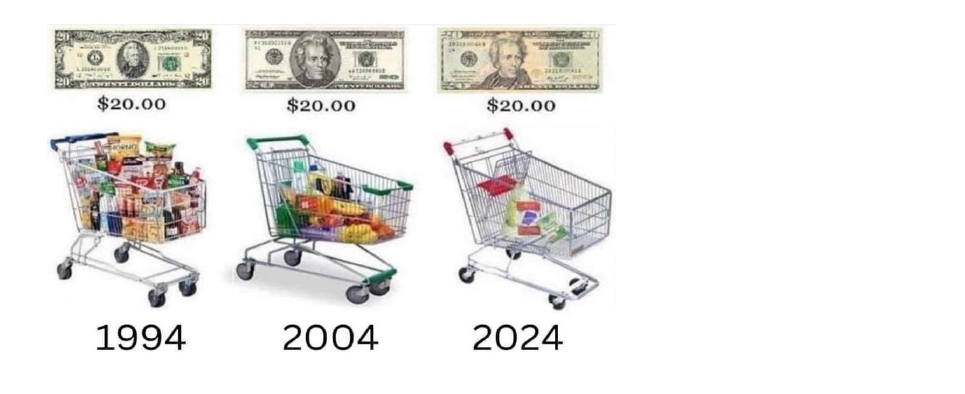

In America, how will inflation and taxes affect you?

- World War I: 77% top tax rate

- World War II: 94% top tax rate

- 1988: 28% top tax rate

- 2025: 37% top tax rate

- Would tax rate go higher? Go figure.

- Inflation During President Jimmy Carter:

- 1979: 13.3%

- 1980: 14.5%

There’s Hope!

95% of Warren Buffett’s wealth was made after age 65. Three (3) reasons:

• Investing skills

• Longevity and Good Health

• The final double is always the biggest.

Three (3) types of income subject to different taxes:

• Earned Income: Wage, bonus, Commission, Self-Employment Tax, Federal Income Tax

• Passive Income: Buy and hold, e.g. Rent, interest, dividend => Federal Income Tax

• Long / Short Capital Gain: Real Estate, Stock, Commodity

It’s not too late. There’re ways to win your 2nd half of life!

• Converting future taxable income into non-taxable income

• Invest in assets that not only beat inflation but generate real returns tax-deferred or tax-free

• If you're self-employed with taxable income over $75,000, you might be overpaying $8-15,000 in taxes.

2025: Tax Planning Till 12-31-2025 – A Window Opportunity Right Now

2026: Tax Filing After 1-1-2026

- Allocate your assets wisely to maximize long-term growth and tax savings

- Diversify and invest in 3 types of assets to generate income while lowering taxes

- Avoid being Equity Rich, Cash Poor: Pay attention to Liquidity, Guaranteed Lifetime Income; so NOT to Outlive Your Money!

Forever Peace of Mind!

To win your second half of life, contact Justina Chen for a free consultation. As a

CPA, Realtor, and Broker for Insurance & Energy, Justina offers one-stop wealth management and retirement/estate planning services to help you build a comprehensive strategy.

Your Path to Financial Clarity and Growth!

We provide one-stop expertise in CPA services, insurance, energy solutions, and real estate, all designed to help you achieve your goals in one place.

Have questions about your finances, taxes, real estate, insurance, or energy needs? We're here to help! At Justina Chen Associates, we believe in building strong relationships and providing personalized support. Whether you're an individual seeking financial clarity or a business aiming for growth, our team is ready to assist you.